Buy Your Business Insurance Today 100% Online!

You Only Pay For The Coverage You Need

General liability starting around $19/month

Workers’ comp starting around $14/month

Bind online instantly with proof of coverage available right away.

Ca License #4135028

WHO WE ARE

About Livingood Insurance

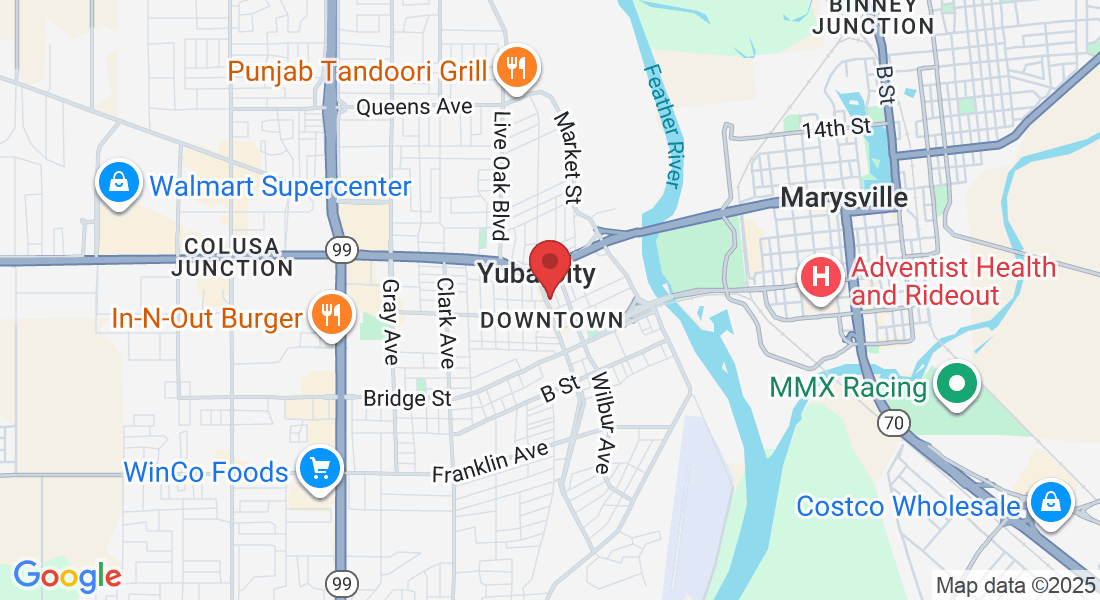

At Livingood Insurance, we're not just insurance brokers; we're your dedicated partners in safeguarding your business. With a legacy of trust and expertise, we have been serving the Yuba-Sutter community and beyond for 5 years. Our mission is simple: to provide tailored insurance solutions that protect your assets, reduce your risks, and save you money.

We understand that every business is unique, which is why we take a personalized approach, working closely with you to assess your specific needs. Our team of industry experts is committed to simplifying the complex world of commercial insurance, ensuring that you have the coverage you need when you need it.

CHOOSE YOUR COVERAGE

GET COVERED TODAY

General Liability Insurance

From $19/m

Covers common business risks like third-party injuries, property damage, and advertising claims. Required for many leases, permits, and contracts.

Workers’ Compensation Insurance

From $14/m

California-required coverage for businesses with employees. Get compliant quickly with coverage designed to keep costs under control.

Professional Liability (E&O)

From $19/m

Protects against claims of mistakes, negligence, or failure to perform professional services.

Commercial Property Insurance

From $18/m

Covers buildings, equipment, inventory, and business property from covered losses like fire or theft.

Additional Business Coverages

From $19/m

Cyber liability, commercial auto, BOPs, inland marine, umbrella policies, and more — customized and competitively priced..

WHAT WE OFFER

Explore all of our Services

Tailored Commercial Insurance Solutions

Highlight your expertise in providing customized insurance solutions for businesses of all sizes and industries. Explain how your brokerage assesses each client's unique risks and needs to recommend policies that offer comprehensive coverage and protection against potential liabilities.

Insurance Program Reviews

Promote periodic reviews of clients' insurance programs to ensure they remain aligned with changing business needs and industry trends. Highlight how your brokerage proactively evaluates policies, recommends adjustments, and explores cost-effective options to optimize coverage.

Trusted by many people in Yuba-Sutter

Answers questions quickly, great at getting a good price on insurance.

Tim Sullivan

Jake was really awesome to work with. He was very knowledgeable. Made it quick and easy to get me coverage when nobody else could!!! I really appreciated it.

Tiffiany McEndree

FAQs

What types of businesses do you specialize in insuring?

At [Your Company Name], we pride ourselves on our versatility. We have experience insuring a wide range of businesses across various industries. Whether you run a small family-owned restaurant, a tech startup, or a large manufacturing facility, we have the expertise to tailor insurance solutions to your specific needs. Our goal is to provide coverage that fits your unique industry and business requirements.

How can I reduce my insurance premiums without compromising coverage?

We understand that controlling costs is essential for any business. Our team is dedicated to finding cost-effective solutions without sacrificing coverage quality. We achieve this by conducting regular policy reviews, exploring discounts, and leveraging our network of insurance providers to secure competitive rates. Additionally, our proactive risk management strategies can help you reduce claims, which can lead to lower premiums over time.

What should I do in the event of a claim?

Claims Handled with Care

OUR TEAM

Jake Livingood | Lic #4135028